Advisory

Rhone High Value Asset Services provides guidance and advice on all aspects of high value asset ownership from initial design and commissioning or acquisition through the use and enjoyment of the asset to its eventual sale or transfer to the next generation.

Tax, VAT and Customs

The taxes relating to high value assets, in particular VAT, are increasingly bewildering, especially given the mobile and international nature of the assets. The tax landscape is continuously changing and tax advisors in different jurisdictions can sometimes give contradictory advice or simply advice pertaining to their own particular jurisdiction without taking into account the cross-border nature of certain assets and the interaction of different tax codes. Rhone High Value Asset Services arranges and coordinates professional tax advice from specialist expert advisors and ensures that clients receive the right tax advice for their individual circumstances and helps clients to fully understand that advice to gain a better and overall understanding of the whole tax picture.

Ownership Structuring

The ownership and use or operation of certain asset classes can create a number of potential legal and fiscal liabilities. Care should therefore be taken to separate the beneficial owner, and their other assets, from the asset in question and thus limit the risk of personal or cross-over liability.

A number of issues, including the nationality and residence of the beneficial owner, the intended use and jurisdictions of use of the asset, need to be taken into consideration to determine a suitable ownership structure to meet the requirements of the client and relevant tax laws. Rhone High Value Asset Services is able to create and administer a variety of bespoke ownership structures in numerous jurisdictions worldwide.

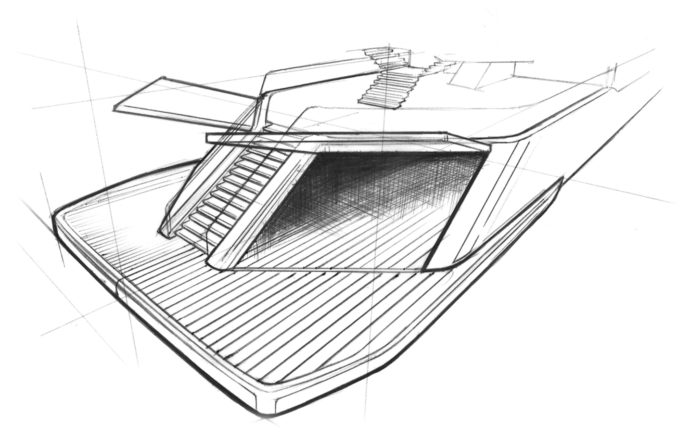

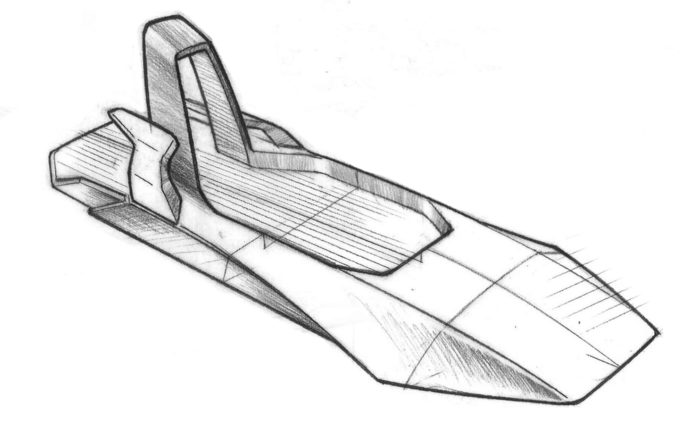

Registration

Certain assets, such as yachts, aircraft and classic cars, must be registered in a particular jurisdiction and this, amongst other things, will determine the governing law of the asset. A suitable country of registration is determined as part of the ownership structuring of the asset and Rhone High Value Asset Services can register assets in numerous jurisdictions worldwide.

Operation

The safe and effective operation of assets such as yachts and aircraft requires the involvement of a number of different service providers such as technical and safety managers, lawyers, insurers and perhaps financiers. These different parties can have different priorities and concerns and if not coordinated and managed properly can prove to be counter-productive to each other. Rhone High Value Asset Services works with an exclusive and trusted network of highly professional partners to ensure that the asset is operated in an effective and efficient manner.

Accounting and

Cost Control

With numerous parties involved and potentially very high costs of operation it is imperative to keep clear accounts and provide objective cost control to ensure that the asset is operated in as efficient and effective a manner as possible. Rhone High Value Asset Services provides the accounting and audit services to do this.